south dakota sales tax rate changes 2021

Simplify South Dakota sales tax compliance. This is the total of state county and city sales tax rates.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Municipalities may impose a general municipal sales tax rate of up to 2.

. South Dakota has recent rate changes Thu Jul 01 2021. 366 rows 2022 List of South Dakota Local Sales Tax Rates. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933.

Gross receipts tax is applied to sales of. Tax rates are provided by Avalara and updated monthly. Michigan prepaid sales tax rates for fuel Missouri.

South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. The South Dakota Department of Revenue has municipal tax information bulletins. The Mitchell sales tax rate is.

Exemptions to the South Dakota sales tax will vary by state. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. 4 lower than the maximum sales tax in SD.

South Dakota municipalities may implement new tax rates or change existing tax rates January 1 or July 1 each year. On October 1 2021 sales and use tax rate changes take effect in the following states. What Rates may Municipalities Impose.

Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. North Dakota sales tax is comprised of 2 parts. For example you may prefer to use a street map vs.

State State Sales Tax. The state sales tax rate in South Dakota is 4500. South dakota v.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. We provide sales. California specifically the City of Isleton Kansas.

30 rows South Dakota SD Sales Tax Rates by City. The South Dakota sales tax and use tax rates are 45. The South Dakota Department of Revenue administers these taxes.

New tax rates. You may want to change the basemap. With local taxes the total sales tax rate is between 4500 and 7500.

The 65 sales tax rate in Sioux Falls consists of 45 South Dakota state sales tax and 2 Sioux Falls tax. 2021 State. As of January 1 2021.

South Dakota first adopted a general state sales tax in 1933 and since that time the rate has risen to 45. Return Period Return Due Date Last Day to Submit ACH Debit Payment Payment Due Date. It allows you to easily identify where points are located.

There is no applicable county tax or special tax. All South Dakota municipal sales tax rates will remain the same on January 1 2021. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2.

Sales Tax Rates by Address. What is South Dakotas Sales Tax Rate. Municipal sales taxes to go unchanged.

Look up 2021 sales tax rates for Delmont South Dakota and surrounding areas. Following the 2018 South Dakota vWayfair US. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 65 across the state with an average local tax of 1814 for a total of 6314 when combined with the state sales tax.

The sales tax jurisdiction name is Sioux Falls Convention And Visitors Bureau Business Improvement District which may refer to a local government division. A topographic map so you can easily. 10-15-2020 0 minute read.

The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. This page allows you to browse all recent tax rate changes and is updated monthly as new. The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax.

For additional information on sales tax please refer to our Sales Tax Guide PDF. Supreme Court decision eliminating the physical presence standard for sales tax nexus nearly every state with statewide sales taxes have adopted collection and remittance obligations for remote sellers and several have implemented marketplace facilitator regimes. Look up 2021 sales tax rates for Turner County South Dakota.

A basemap is the background map that provides reference information for the other layers. Select the South Dakota city from the list of popular cities below to see its current sales tax rate. The 2022 state personal income tax brackets are updated from the South Dakota and Tax Foundation data.

10 rows Raised from 45 to 65. The minimum combined 2022 sales tax rate for Mitchell South Dakota is. The sales tax is paid by the purchaser and collected by the seller.

Before the official 2022 South Dakota income tax rates are released provisional 2022 tax rates are based on South Dakotas 2021 income tax brackets. Tax rates provided by Avalara are updated monthly. The South Dakota sales tax rate is currently.

North Dakota tax rate changes and local taxing jurisdiction boundary changes Ohio. New farm machinery used exclusively for agriculture production at 3. The state sales and use tax rate is 45.

Average Sales Tax With Local. The maximum local tax rate allowed by. Did South Dakota v.

South Dakota is ranked number twenty seven out of the fifty states in order of the average amount of property taxes collected. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. The County sales tax rate is.

South Dakota has state sales tax of 45 and allows local governments to collect a. What is Change Basemap.

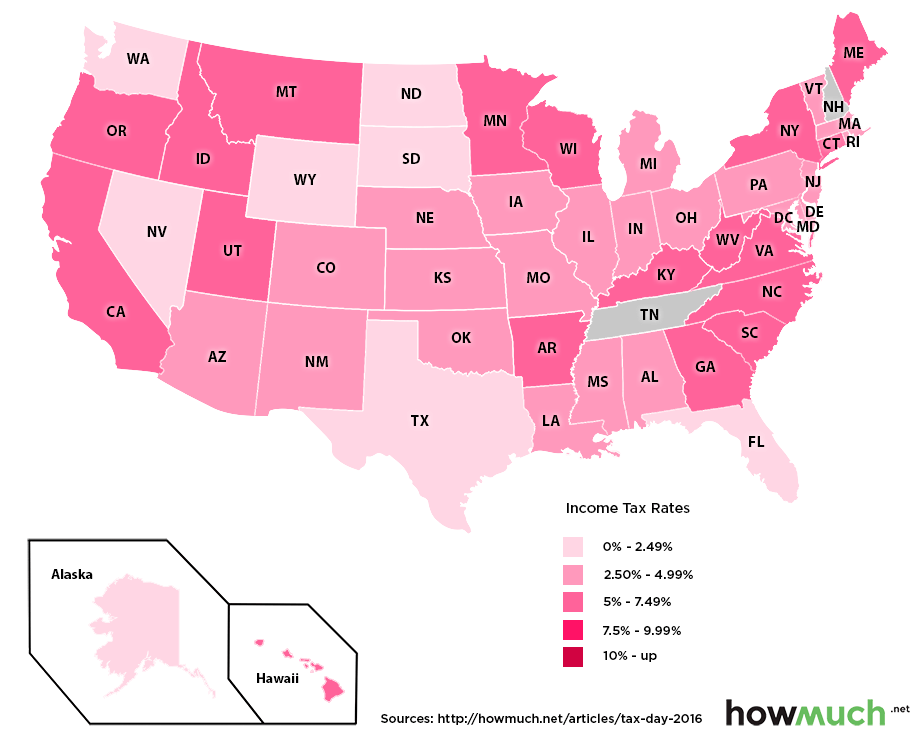

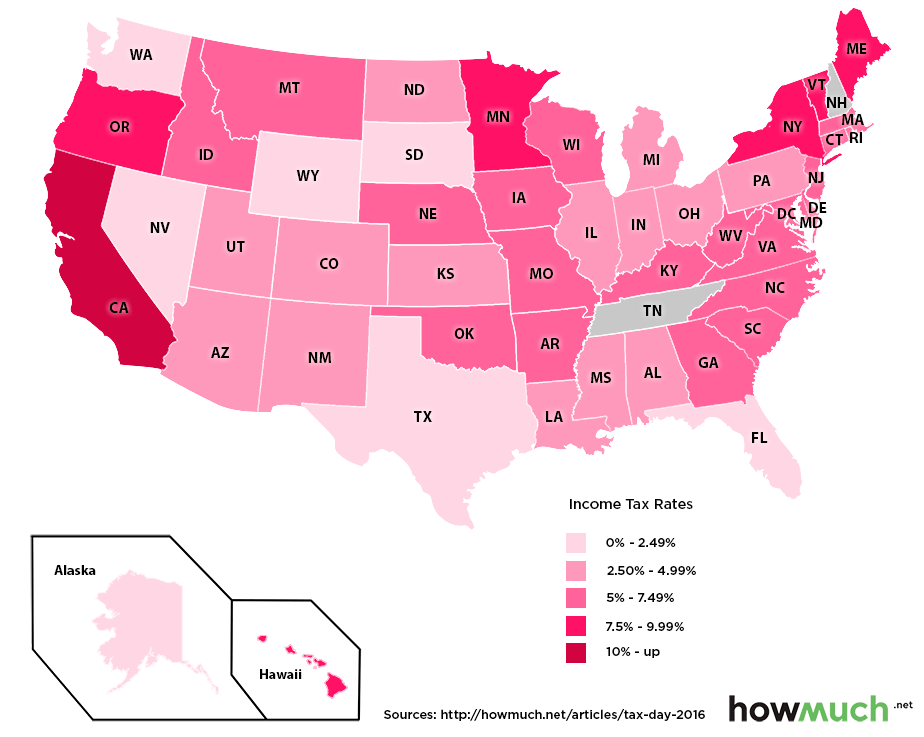

Which U S States Have The Lowest Income Taxes

Which U S States Have The Lowest Income Taxes

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Updated State And Local Option Sales Tax Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Sales Tax Definition What Is A Sales Tax Tax Edu

North Carolina Sales Tax Small Business Guide Truic

New Municipal Tax Changes Effective July 1 2021 South Dakota Department Of Revenue

How Do State And Local Individual Income Taxes Work Tax Policy Center

Sales Tax Expert Consultants Sales Tax Rates By State State And Local Rates

Sales Tax By State Is Saas Taxable Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

Ranking State And Local Sales Taxes Tax Foundation

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

How Is Tax Liability Calculated Common Tax Questions Answered